Award-winning PDF software

f1065--.pdf - internal revenue service

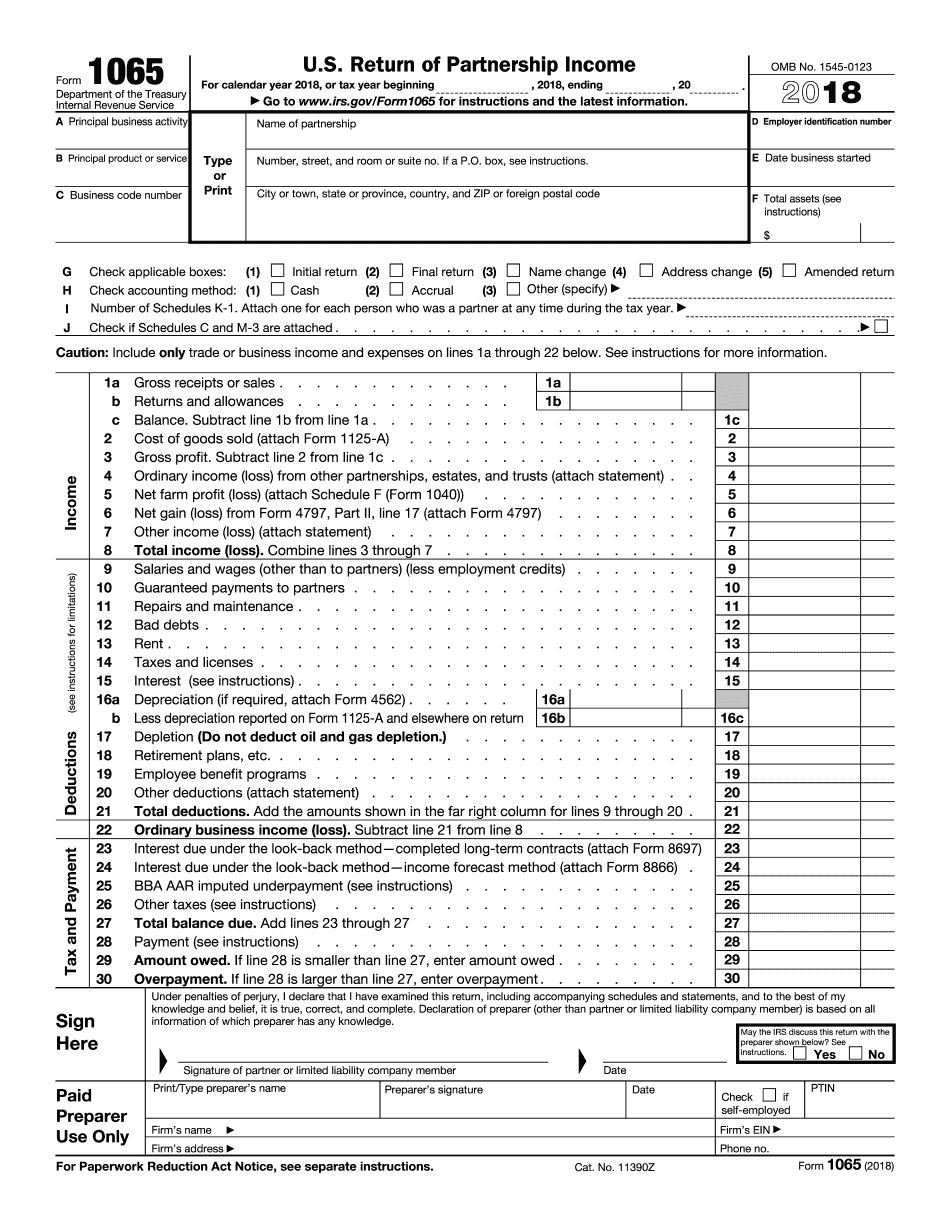

January 1, 2018. Form 1065, Partnerships Return of Partnership Income. For calendar year 2018, or tax year beginning. January 1, 2018. (Attach a copy to the completed form.) Attachment 835. Department of the Treasury. Internal Revenue Service. Form 1061 (Establishment of Corporate Limited Liability Partnership). October 1, 2017. Copy attached. Form 1061 (Establishment of Corporate Limited Liability Partnership). October 1, 2017. Copy attached. (Attach to Form 1061, Form 1065, or Form, Notice of Listed Corporate Partnership, if applicable.) Attachment 836. Department of the Treasury. Internal Revenue Service. Form 1065-B (Establishment of Domestic Corporation). April 1, 2017. Copy attached. Form 1065-B (Establishment of Domestic Corporation). April 1, 2017. Copy attached. (Attach to Form 1065, Form 1065-B, or Form, Notice of Listed Domestic Corporation, if applicable.) Attachment 839. Department of the Treasury. Internal Revenue Service. Forms 1065A-B (Establishment of Domestic Limited Liability Partnership and Listed Domestic Partnership) and (Form of Election to Avoid.

i1065--.pdf - internal revenue service

Public Law 115-21. Mar 21, 2017. Form 1065 Income Tax Return for: Partnership Interest (except a non-taxable interest in a farm) Partnership Income (including rental income) Return of Partnership Interest Enter your partnership's federal tax return number, name, address, and the amount reported under the “partnership income” line (as shown on Schedule K-1. However, if the partnership is not required to file a federal return, leave this line blank.) You report partner income on Schedule K to your partnership's income tax return and are considered to have reported the fair market value of your partnership interest when filing Schedule K-1 for this year. For details, see Schedule K-1 (Form 1040). If the partner income reported is over 600, you are not required to file a federal tax return for this year. Contact your partnership's financial institution for advice on how to report the partner income on your partnership's tax return. If you are filing Form.

schedule k-1 (form 1065) - internal revenue service

Internal Revenue Code of 1986. Internal Revenue Service Rulings. Vol. 77, No. 12. 2018. [FR Doc.

About form 1065, us return of partnership income - internal

See the Form 6251 Instructions that accompany each IRS Form 1065, Return of Partnership Income (with information that does not apply to this item) to follow specific instructions for filing, or ask an experienced representative who knows the information to assist you. See Additional Info on the form to follow general information about tax withholding requirements, reporting rules, and exceptions for individuals. See the General Instructions for Trust Income Tax for additional information about the trust that pays these taxes, and the requirements for filing and payment of these taxes. See the instructions for Form 8854, IRS 1040-ES, Estimated Tax for individuals. These instructions include information about how to prepare and file, and about the calculation and payment of interest and penalties. See the Instructions for Form 8955, Estimated Tax for Individuals. These instructions include information about how to prepare and file, and about the calculation and payment of interest and penalties. See the.

Prior year products - internal revenue service

You are a joint resident spouse, qualifying member of a nonresidential, nonpassive retirement plan who elects to be treated as a resident of the United States for federal tax purposes (not on Form 1040). You may need to file Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. for the partnership. 1A. If you file the joint return of your spouse and a resident other than the spouse, the resident spouse can elect to be treated as a resident of the United States for federal tax purposes solely because it is your spouse's principal home and he or she did not own or occupy any other place of habitation in the United States as his or her principal home as of the start of the year. 2. You qualify for the standard deduction for joint filers who file a joint return. You cannot claim any itemized deductions in this year..