Award-winning PDF software

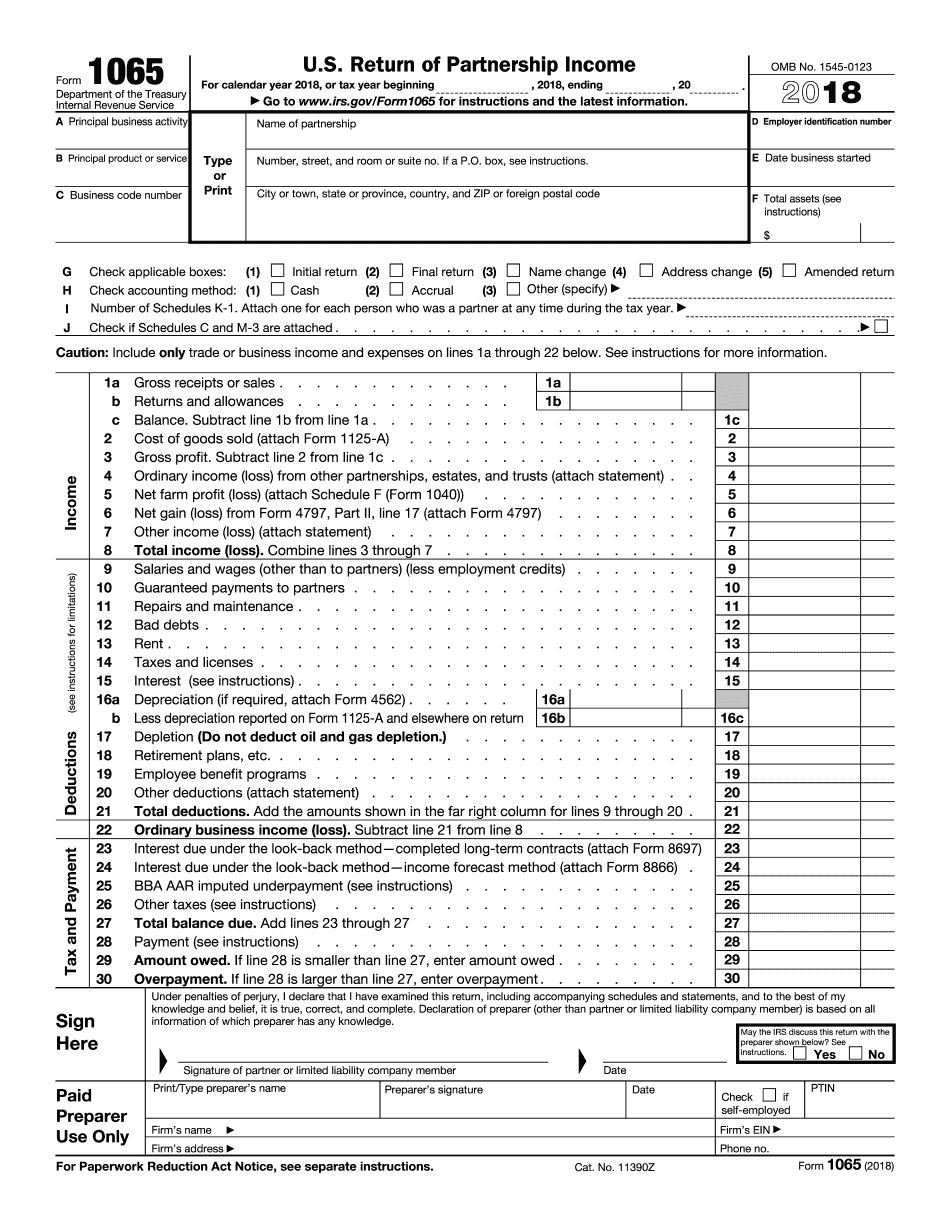

IRS 1065 2024 Form UT: What You Should Know

Nevada State Lottery Taxpayer Information Register to make your selections. Only one registration is allowed per account. Pay the required amount of 20.00 on the Tax Form. This will be deposited to your account. Please enter your first and last name, Full Name (in full): Full Address: Last 5 Social Security Numbers: Credit Card Information (required unless you have already used their service): If you have not already, please provide payment information to pay the applicable taxes. For questions on the lottery program you can email NevadaLotteryStateofNevada.info. For those registering by mail, please use these instructions for submitting payment by mail. Payments must be received at the address specified above. Payments of not less than 20 percent of your payment amount, together with the related delinquent tax and late fee payments must be made by check or money order in U.S. money. Payments OF 20% OF FULL ANNUAL AMOUNT ARE NONREFUNDABLE. There is NO REFUND policy under the State lottery program. To avoid possible loss of tax credits, please allow up to 7 calendar days after the payment is authorized for each payment type to process any applicable credits and fees due under the State program or in connection with that payment. Please see Nevada County Lottery Taxpayer Information page for information about your county's lottery and other related taxes and fees. Information on the Nevada Tax Commissioner : State lottery, tax credit interest and penalties, Nevada lottery, tax credit interest, lottery fraud, lottery fees, Nevada lottery, taxes assessed for lottery winnings, Nevada County Lottery Program Nevada County lottery programs are administered by the Nevada Department of Taxation. These systems are designed for taxpayers to access information and documents about your county lottery program. Nevada County Lottery Program Nevada Casino Program Nevada State Lottery Nevada State Lottery is administered by the Nevada Department of Taxation. You may use this computer system primarily for accessing a database used to determine lottery eligibility. Please note that no personal information is collected or stored using this system. However, the system enables you to register, manage your personal information, and make selections within the state lottery system. Please see Nevada Division of Public and Behavioral Health Lottery Program, Division of Gaming Control Lottery Program, and Division of Consumer Protection Lottery Program for additional information about lottery programs.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete IRS 1065 2024 Form UT, keep away from glitches and furnish it inside a timely method:

How to complete a IRS 1065 2024 Form UT?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your IRS 1065 2024 Form UT aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your IRS 1065 2024 Form UT from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.