Award-winning PDF software

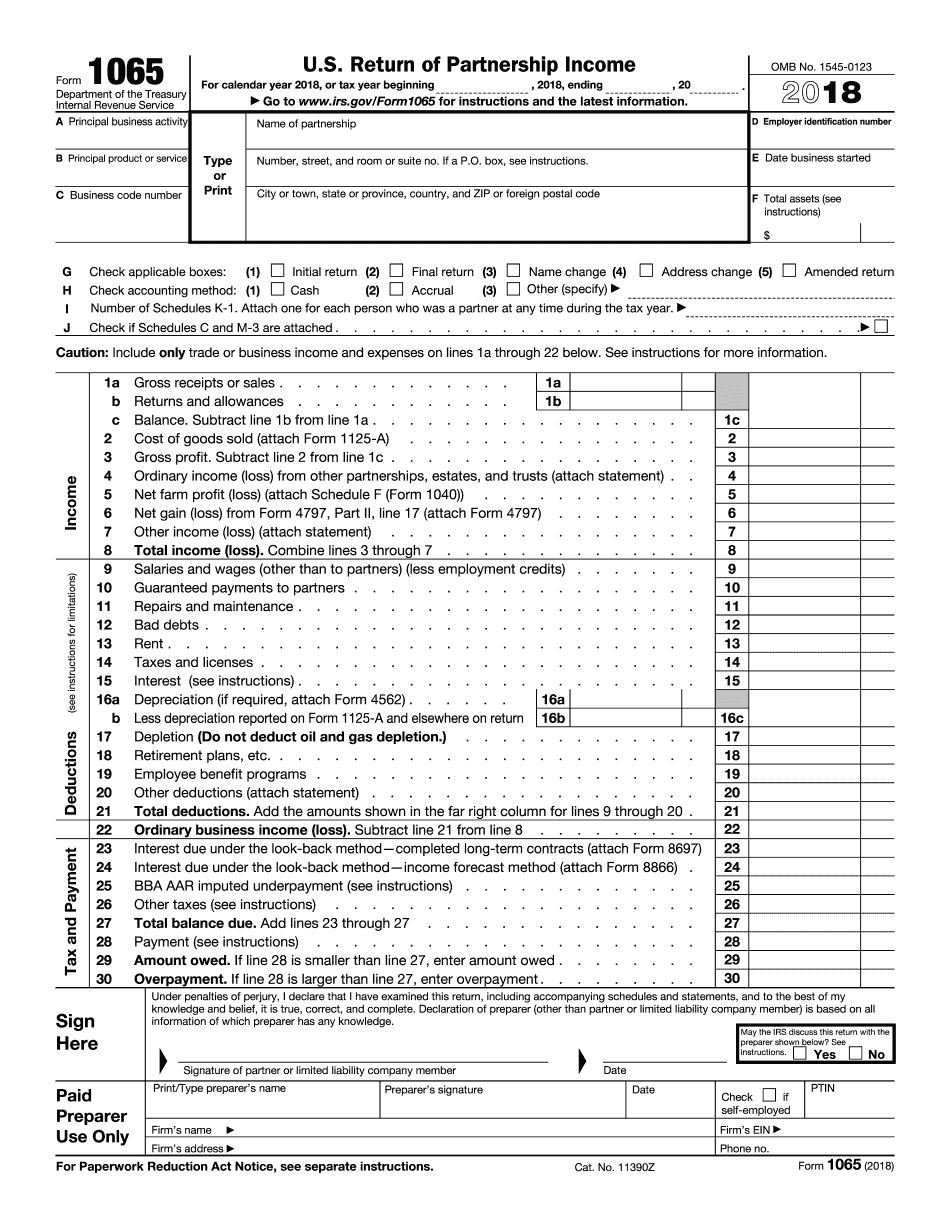

Printable IRS 1065 2024 Form Florida: What You Should Know

A shareholder filing a Form 1065 reporting the distributive share of partnership income may use Form 1065-B and Florida Forms 7-1120B to report on Form 1065. Florida Tax Guide to Corporate Transactions A partnership will have its federal income taxes withheld from dividends and capital gain income of each partner. If the partnership chooses to have its tax withheld, that partnership must allocate all such income. For partnership, there are two steps to allocate partnership income. Step 1: Dividend and Capital Gain Allocation To allocate income, partners determine the distributive share of partnership income using Form 1065. Generally, partners divide partnership income between themselves and report the result to the IRS. The partners report their dividends and capital gains directly to their distributive share of the partnership. Step 2: Apportionment Factors Any partnership adjustment to the distributive share of partnership income is apportioned to each partner according to their distributive share of partnership income. The apportionment factor to allocate to each partner depends on each partner's income. The amount of the apportionment factor depends on the partnership's distributive share of partnership income in effect because of the partnership-level tax tables. The apportionment factor must be equal to and at least one-third of the total difference between the partnership's distributive share of partnership income and the total of any income reported on Form 1065 of the partnership. There are several apportionment factors. The table for each percentage in which the distribution factor is reduced or increased is available online in IRS Publication 725. Tax Division The tax division is responsible for the administration, collection and collection services for the state. Generally, the tax division is the collection manager for State of Florida tax matters. Tax Division has three basic functions: Collecting the income tax; Collecting and disbursing the motor fuel tax; and Providing financial and administrative support to the agency. See the State of Florida Department of Revenue (Tax Division) — Tax Division website. Tax Division is located at 11300 State Road 28 West, Tampa, FL 33. Phone:, or toll-free, Fax Number:. The following information is intended to provide general information only and may not be considered legal advice.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable IRS 1065 2024 Form Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable IRS 1065 2024 Form Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable IRS 1065 2024 Form Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable IRS 1065 2024 Form Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.